Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|  Chime – Mobile Banking | ||

Version: 5.173.0 Updated: Jun 13, 2023 Size: 184.9 MB Category: Finance | |||

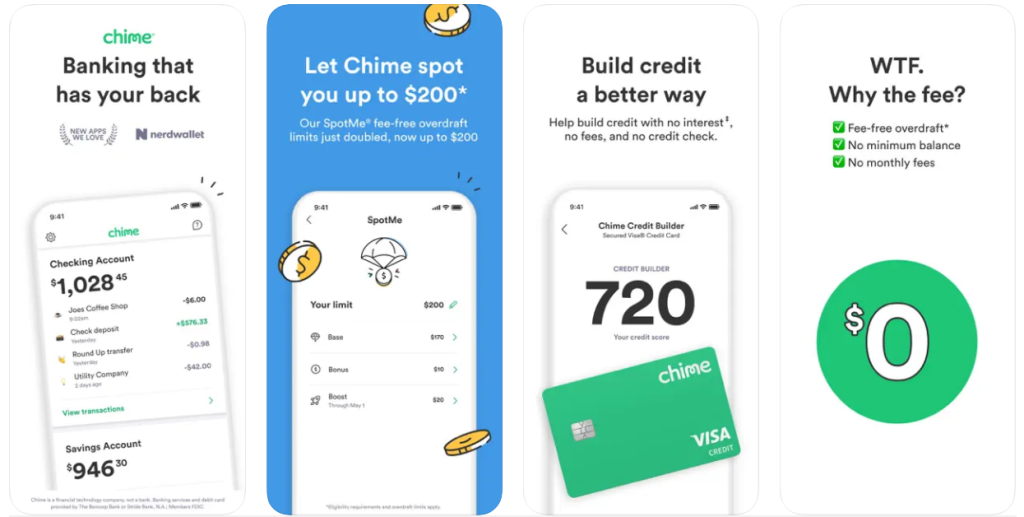

Chime is a modern banking app tailor-made for today’s constantly connected world by putting individuals’ financial needs at the core of its innovation. Launched in 2013, Chime provides a set of banking services that cater to consumers looking for a simple, secure, and convenient way to manage their personal finances. Designed to make banking hassle-free, Chime aims to cater to individuals who prefer mobile banking by offering essential services like checking accounts, savings accounts, and mobile payment options without the fees and penalties that other traditional banks impose.

The Chime App’s features emphasize real-time account monitoring, automatic savings, fee-free transactions, and mobile-first execution. By combining the best aspects of digital and traditional banking, Chime strives to provide a seamless banking experience for its users. Its Visa Debit Card not only gives account holders the flexibility to access their funds, but also promotes usage through cash-back incentives and fee-free transactions. In essence, Chime is banking reimagined for the digital era, with features aimed at making life simpler for its customers.

In a nutshell, the Chime App offers a range of features designed to simplify personal financial management for its users. Some of its most notable attributes include mobile-first accessibility, cutting-edge security measures, fee-free banking, an intuitive interface, and various savings tools.

Chime is designed as a mobile-first banking app, which allows users to access and manage their accounts entirely from their smartphones. From opening an account to depositing checks and paying bills, users can complete a wide variety of banking tasks from the convenience of their mobile devices.

Chime takes the security of its users seriously and employs advanced encryption technology to protect account information. It also offers two-factor authentication (2FA), along with fingerprint and face recognition, giving users peace of mind knowing their accounts are secure.

One of Chime’s most significant advantages is its fee-free banking services. Users can enjoy the benefits of a Chime Spending Account, without worrying about hidden fees, monthly maintenance fees, or overdraft charges. This approach helps users save money in the long run.

The Chime App boasts a user-friendly interface that makes it easy for users to navigate across its features. This accessibility allows individuals to monitor their spending, manage their accounts, and set saving goals, all from within the app.

With Chime, users can automatically round up their purchases to the nearest dollar and move the spare change into a Savings Account. This feature, combined with the option to set up automatic transfers of a percentage of each paycheck into a Savings Account, can help users save effortlessly.

The Chime Visa Debit Card lets users access funds from their Chime Spending Account and supports fee-free transactions at over 60,000 ATMs. Additionally, the Get Paid Early feature enables eligible users to receive their paychecks up to two days earlier than the standard payday.

Varo Bank

Varo Bank offers a mobile banking solution that combines convenient and simple personal financial management with a suite of money-saving tools. Varo provides users with a fee-free checking and savings account, as well as an automatic savings feature to help users reach their financial goals. With no minimum balance requirements or monthly fees, Varo Bank is a solid alternative to traditional banking services.

Simple Bank

Simple Bank is another mobile-first banking app that streamlines account management and personal finance tracking for users. It offers a no-fee checking account, savings tools, automatic budgeting, and easy goal-setting features. Simple Bank also offers a Shared Account feature that allows users to manage joint finances with their partners.

Current Bank

Current Bank aims to provide a comprehensive banking experience with its mobile-first platform. Offering both personal and teen checking accounts, Current allows account holders to manage their finances, set spending limits, and receive real-time notifications. Additionally, the Current Bank Visa Debit Card supports fee-free transactions at over 55,000 ATMs and cash back at participating merchants. Its approach to banking is designed to cater to various age groups and offer user-friendly financial management tools.

| Chime – Mobile Banking |

Version 5.173.0 | Size |

Updated | Rating |

Category | Developer |